So the year 2021 should have been more normal?

The stock market was anything but. The markets peaked in January and then quickly descended into chaos. Turbulent stock market trading on GameStop and other previously inactive stocks was sparked, but then led to a general market decline. In February, stock market indexes rose again to record or near-record levels.

According to Refinitiv Leeper, when the dust settled, the total return of the average diversified equity fund in the US was negative 0.3% in January. As a category, the funds are up 19.1% for the full year 2020, despite economic pressures due to the Covid 19 pandemic and location.

International equity funds, which rose an average of 12.6% in 2020, fell 0.83% in January.

“The year starts off weird,” he says.

Sylvia Jablonski,

Investment Director at Defiance ETFs in New York. “We have a new president, the election in Georgia is behind us, and things are getting better with Covid vaccines,” she says, “there’s more money in the market and everything else.

“But we also had this weird Wall Street thing where we didn’t know who,” Jablonski adds, referring to the trading war between small traders and hedge funds that affected GameStop and other investments. The money rally, which came out of nowhere, was also part of the excitement.

Meanwhile, small stock funds have emerged, including value funds that buy stocks that are considered undervalued. Value funds took hits for much of the past year due to the pandemic, but analysts have predicted that they will do better once the economy improves. Small-cap funds averaged 3.7% from January to June and nearly 32% in the last three months. This exceeds the 2.8% increase in small-cap funds in January and 28% in the last three months.

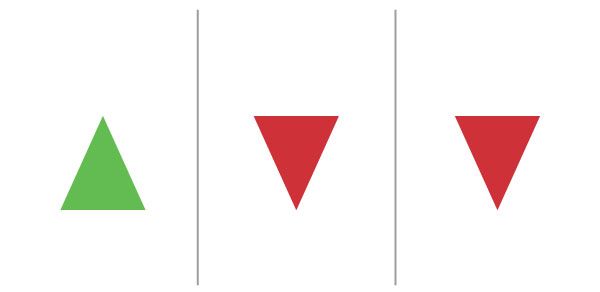

Scoreboard

Fund performance for January 2021, total return by fund type.

Jablonski says she expects the U.S. economy to continue to improve, leading to an uptick in what she calls the “return of life in America” – airlines, casinos, hotels and services – and an increase in consumer spending.

She says she wouldn’t necessarily sell “quality or growth names” now. “There’s a lot of talk in the market

Apple,

AAPL -0.31%.

Amazon.com,

0.63% AMZN

Google parent].

Alphabet,

GOG 1.73% 1.73% 1.73% 1.73% 1.73% 1.73% 1.73% 1.73

Tesla

TSLA 0.26%.

и

Microsoft

MSFT 0.08%.

are overvalued, but they represent an overwhelming profit. The only thing that has driven the market down is the ability to “sneak buy,” she says.

Bond funds fell in January. Investment grade medium-term bond funds (the most common type of bond fund) fell 0.57% in January after rising 8.2% over the past year.

Mr. Power is the editor of the Wall Street Journal in South Brunswick, NJ. E-mail him at [email protected].

Copyright ©2020 Dow Jones & Company, Inc. All rights reserved. 87990cbe856818d5eddac44c7b1cdeb8